As we move deeper into 2025, the landscape of financial data insights, dashboards, and reporting is undergoing a profound transformation. At the heart of this evolution is artificial intelligence (AI), which is no longer a futuristic concept but a core driver of value, efficiency, and strategic decision-making in finance.

AI: From Automation to Strategic Intelligence

AI has rapidly advanced beyond automating routine financial tasks like invoice processing and reconciliations. Today’s AI-powered tools deliver real-time insights, process thousands of transactions simultaneously, and seamlessly integrate with enterprise systems, ensuring financial data is always current and accurate. This automation frees finance professionals to focus on higher-value analysis and strategic planning.

Real-Time, Predictive, and Explainable Insights

Modern AI platforms go far beyond historical reporting. They enable predictive analytics, forecasting trends, and identifying risks before they materialise. Through natural language processing, AI can even analyze external data—such as market news and social sentiment—to provide a comprehensive, forward-looking view of the business environment. The rise of explainable AI (XAI) is also making financial dashboards more transparent, allowing decision-makers to understand the rationale behind AI-generated insights, which is crucial for compliance and building trust.

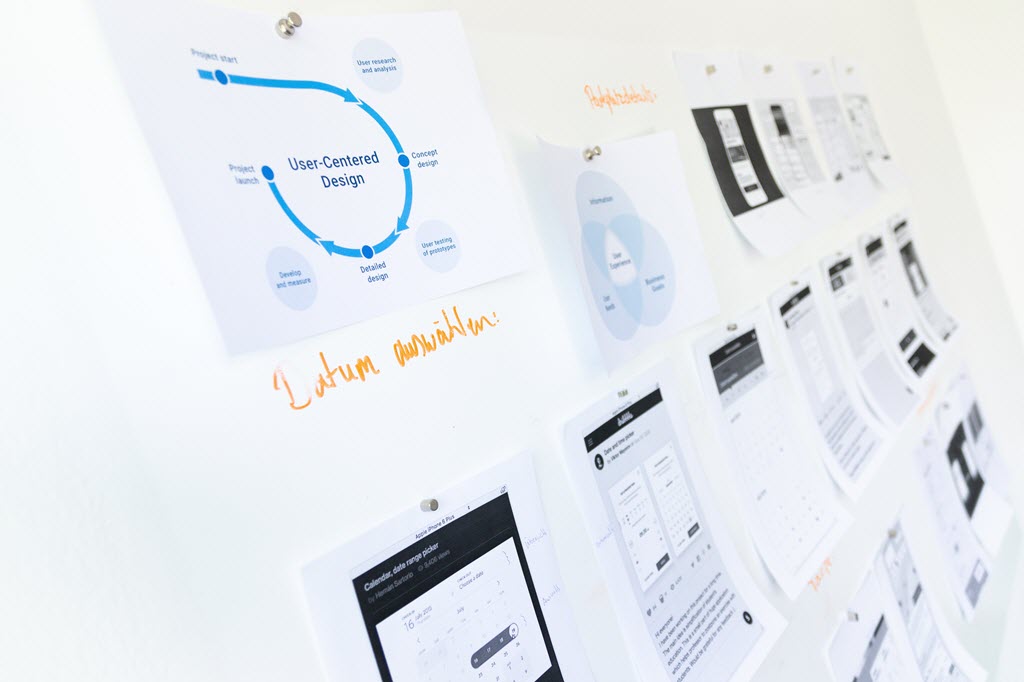

Dashboards That Empower, Not Overwhelm

AI-driven dashboards are becoming more intuitive, personalised, and interactive. They surface the most relevant KPIs and trends, adapting in real time to user needs and market changes. With AI’s ability to detect anomalies and flag potential issues instantly, finance teams can shift from reactive reporting to proactive management, making faster and more informed decisions.

The Rise of Generative AI in Financial Reporting

Generative AI is being rapidly adopted for financial reporting, with over 40% of organisations piloting or using it and 95% of leaders expecting to leverage it within three years. These tools automate data gathering, trend analysis, and even narrative report generation, allowing finance staff to focus on value-adding tasks. The result is faster, more accurate, and more granular reporting that enhances both compliance and strategic agility.

Challenges and the Path Forward

Despite these advances, challenges remain. Data quality, security, and the need for skilled talent are ongoing concerns. Leading organisations are addressing these by investing in robust data governance, upskilling teams, and piloting AI projects with clear ROI targets.

What’s Next?

Looking ahead, AI will continue to push the boundaries of what’s possible in financial insights and reporting. Expect more autonomous, embedded, and personalised financial experiences, with AI agents proactively surfacing opportunities and risks. Real-time, explainable, and predictive dashboards will become the norm, empowering finance leaders to steer their organisations with unprecedented clarity and confidence.

In summary:

The future of financial data insights, dashboards, and reporting is intelligent, real-time, and deeply integrated across the business. AI is not just a tool—it’s the new engine driving finance into a future where insights are instant, reporting is proactive, and every decision is powered by data you can trust